Latest News

Indian stocks rally on a day RBI raises repo rate

New Delhi: Indian stock markets continued with their early gains even after the announcement of the outcome of the RBI's monetary policy meeting, as they were largely in line with market participants' expectations.

Sensex closed at 60,663.79 points, up 377.75 points or 0.63 per cent, whereas Nifty closed at 17,871.70 points, up 150.20 points or 0.85 per cent. RBI's monetary policy meeting on Wednesday decided to raise repo rate by 25 basis points to 6.50 pc. Repo rate is the rate at which the RBI lends money to all commercial banks.

Since May last year, the RBI has increased the short-term lending rate by 250 basis points, including that done today to contain inflation.

India's retail inflation was above RBI's six per cent target for three consecutive quarters and had managed to fall back to the RBI's comfort zone in November 2022.

"Bulls took charge of the markets as the RBI's MPC meeting delivered a smaller rate hike in line with market expectations. RBI has taken a more optimistic view on domestic growth by increasing the GDP forecast while cautiously keeping CPI inflation at 5.3 per cent for FY24," said Vinod Nair, Head of Research at Geojit Financial Services.

"Meanwhile, global markets traded with hopes as investors digested Powell's speech, which stated that disinflation had begun but pointed towards the possibility of further rate hikes in response to a stronger job market," Nair added.

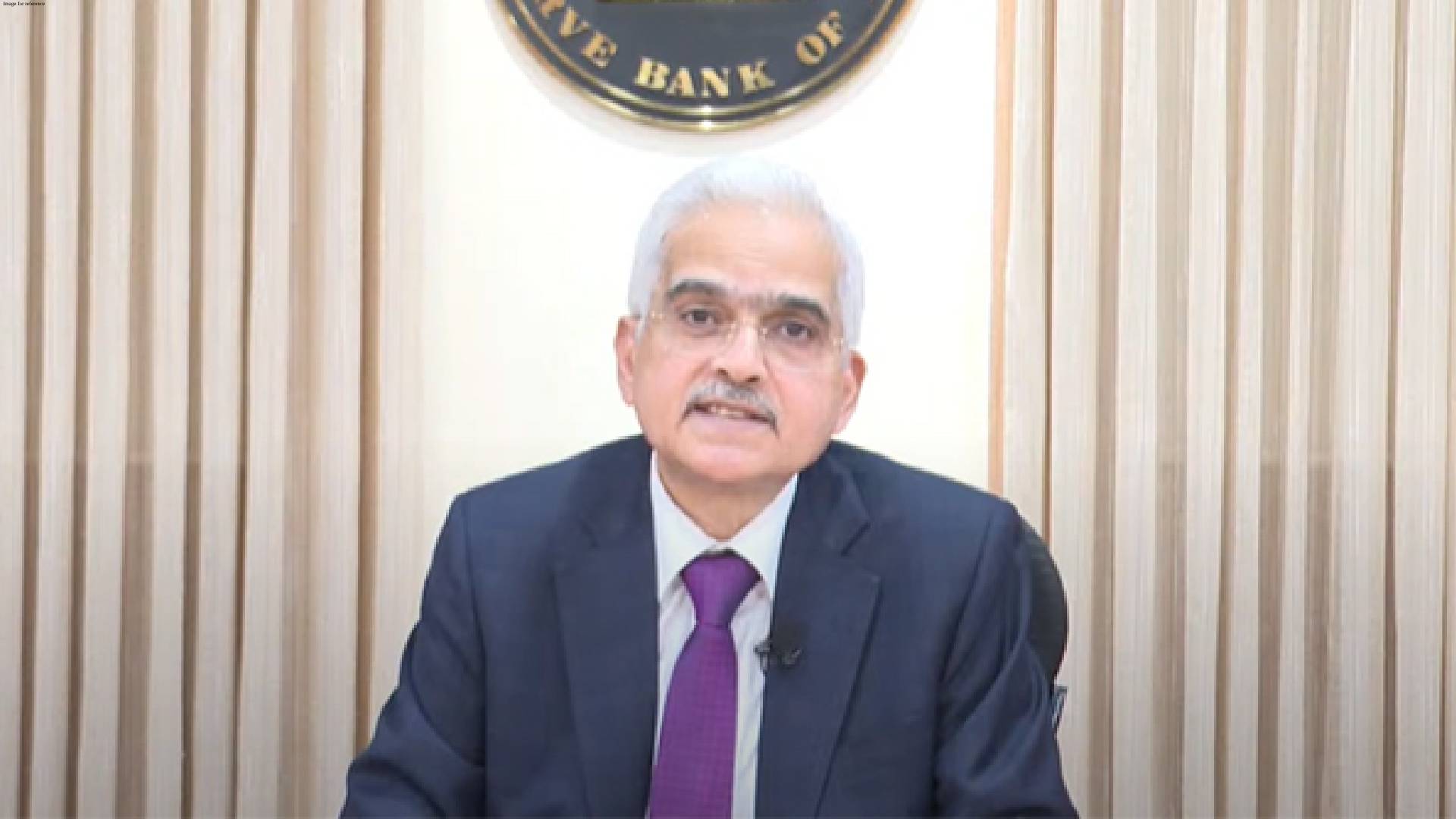

Average retail inflation in India is projected to be at 5.3 during the next financial year 2023-24, the Reserve Bank of India governor Shaktikanta Das said on Wednesday while announcing monetary policy outcomes.

The projection, Das said, is based on the assumption of a normal monsoon. The average inflation in Q1 2023-24 is expected at 5.0 per cent, Q2 at 5.4 per cent, Q3 at 5.4 per cent, and Q4 at 5.6 per cent, respectively.

"Considering domestic inflation outlook, growth prospect of the economy and emerging global scenario, RBI has decided to hike the policy rates by 25 bps. The outcome is in line with the market expectations and gives confidence on the RBI's efforts to keep the economy resilient, support growth during the present global uncertainties and to control inflation," said Shanti Lal Jain, MD and CEO of Indian Bank.

Notably, shares of some Adani Group companies, which are in news for over a week now, reversed from their recent losses to rise substantially on Wednesday, though with varying degrees.

The conglomerate's flagship company Adani Enterprises' shares closed over 23 per cent higher at Rs 2,220.

Adani Ports rose 9 per cent, Adani Transmission rose 5 per cent, Adani Wilmar rose 5 per cent, and Adani Power rose 5 per cent. On the contrary, Adani Green and Adani Total declined 5 per cent each.

Since the January 24 report by a US-based short seller Hindenburg Research, which claimed the Adani Group of having weak business fundamentals and accused it of stock manipulation and accounting fraud, the shares of the conglomerate's listed companies had fallen substantially.

In a long response, Adani Group had said the report by Hindenburg Research was not an attack on any specific company but a "calculated attack" on India, its growth story, and ambitions. It also added the report was "nothing but a lie". (ANI)

.png)

.png)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.jpg)

.jpg)

.png)